By Lynée L. Wells, AICP

|

|

| A mobile tour helped members of the Uptown CIA board determine projects to accomplish with TIF revenues. |

Michigan’s strip commercial corridors are showing evidence of decline. Our abundant stock of vacant commercial storefronts, empty swaths of parking lots, and overgrown landscaping are no secret. Communities mull the challenges of revitalization and how to repurpose and reprogram these commercial corridors; after all, they were once thriving places to incubate new business. While the needs are great in these corridors, the opportunities are equally compelling.

After watching the 2010 TEDX Atlanta video of making a case for retrofitting suburbia, I realized the opportunity we have in Michigan to utilize the Corridor Improvement Authority Act to help effect change. Act 280 of 2005 is more than legislation, it is an opportunity for local leaders, business owners, and residents to invest tax increment revenues back into the area of the community where they were generated, and to rely on citizen stakeholders to prioritize those revenues for revitalization. This is small government at its best.

Rationale for Corridor Improvement Districts

Corridor Improvement Districts (CIDs) bring community officials together with local stakeholders to invest in suburban and neighborhood revitalization. Talented, experienced, and knowedgeable local stakeholders match revitalization projects with self-defined priorities and overcome local obstacles to investment. The pace, projects, and priorities are locally derived and locally managed. Putting the onus of revitalization into the hands of business and property owners means there is skin-in-the-game. This is where change happens.

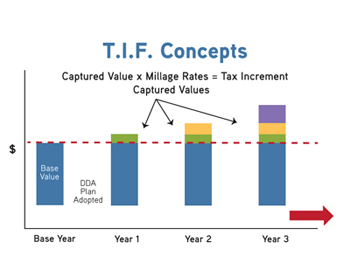

Local leaders tend to shy away from tax increment financing because they are concerned that constituents may think it will raise taxes, or worse, detract from the general fund. Tax increment financing is not a tax increase nor is it a new tax. The base value (or existing tax base) remains with the taxing jurisdictions. Tax increment revenue generated by growth in value does not go to the general fund to be spent throughout the municipality, county, or other taxing jurisdiction—it returns to the place where it was generated, that portion of the community with the established Corridor Improvement District.

Aside from the economic reinvestment in the district, a Corridor Improvement Authority Board of Directors (the board appointed to oversee the CID) becomes an organized entity coalescing ideas, mobilizing and advocating interests, and effecting change. The authority sets its budget, works to market the district, plans and hosts events, and collaborates with other business districts. Some worry about local fiefdoms; however, the board is appointed by the local government, and the local elected officials are also responsible for approving the CID’s budget. These checks and balances ensure that the CID and the municipality are working collectively toward revitalization. Other benefits include the CIDs ability to bond, purchase, manage and sell properties, and enter into intergovernmental agreements with adjacent municipalities.

Basic Elements of a CID

The first step in determining whether a CID is possible in your community is to verify that the target area complies with the following statutory requirements:

• Located adjacent to or within 500 feet of a collector or arterial road

• Contains at least five acres or 10 contiguous parcels

• More than 1/2 of the ground floor area is commercial in character

• Past uses are residential, commercial, or industrial

• Served with water or sewer

• Zoned to allow mixed-use and high density residential

• Has been in existence for the last 30 years

Once general boundaries are identified, community outreach and involvement should begin in earnest. Ideally, the local stakeholders take the initiative towards revitalizing their community.

However, the local government can also take a leadership role by ensuring statutory requirements are met and all interested parties are represented during the planning and approval process, and by providing assessing records essential for projecting future tax increment capture and anticipated growth rates. Key stakeholders to involve include:

• Any entity that would forego incremental revenue increases

• Property owners and business owners leasing property

• Homeowners/residents

• Nonprofit entities involved in community development, housing, and revitalization

• Legal counsel

• Community officials (elected and appointed)

• Business and neighborhood associations

• Press/media

• Potential funders/donors

• Potential developers or developers active in the community

The time and effort it takes to galvanize support, educate affected property owners, involve taxing jurisdictions, coordinate with local government, and complete the required development and tax increment financing plans can be daunting. To maintain momentum, business owners might consider collaborating with a local nonprofit to serve as a fiduciary, enabling them to apply for grants from local community foundations and corporations to hire a consultant. An outside consultant, someone other than a local official, resident or business-owner, provides the taxing jurisdictions and property owners a neutral voice, one they could trust to explain the nuance of tax increment financing in a clear and concise manner. This approach allows local stakeholders to devote their time “in the field” building support, answering questions, and ensuring broad outreach for the revitalization effort.

|

Uptown CID

When we worked with the city of Grand Rapids and neighborhood stakeholders to form the Uptown Corridor Improvement District, the role of community planners was reinforced. As consultants we were responsible for organizing a mobile tour with stakeholders to determine projects to accomplish with TIF revenues, hosting a community consensus-building event where projects were refined and prioritized, and for writing the Development and Tax Increment Financing Plans. Ultimately, the public involvement we facilitated resulted in a development plan comprised of projects which were truly locally generated based on the resident, business owner, and property owner’s immediate and long-term needs.

| What Is a Corridor Improvement Authority?

A Corridor Improvement Authority (CIA) is a tax increment financing (TIF) tool to promote economic development. It allows TIF to be used for commercial and economic growth in commercial districts in cities, villages and townships. Local units can use taxes arising from increased property values through TIF to pay for improvements to commercial areas along arterial or collector streets and roads. It allows communities that already have Downtown Development Authorities (DDAs) to extend similar benefits to aging commercial corridors outside the DDA district or that extend through more than one municipality. Corridor improvements may include improvements to the land, as well as constructing, rehabilitating, preserving, equipping or maintaining buildings within the development district for public or private use. These improvements may be financed initially through bonding, which may be repaid from the enhanced property tax revenue stream, special assessments and fees. |

Forming the Uptown Corridor Improvement District was not without its challenges and lessons learned. As with any community-based development work, volunteer effort is necessary. Local officials should reach out to community leaders for support to make sure the process is streamlined and dynamic, educational and participatory. The process requires a group of local stake-holders, working in concert, advocating for their corridor and setting a robust vision for revitalization.

|

With decreasing property values, and the aging of these corridors, establishing a CID provides a foundation for community organizing and a vehicle for reinvestment. Many believe property values have hit a low point in our communities. By establishing the CID now, there is an improved potential for increased values and greater tax increment. While the increment may be modest initially, the CIA board can be strategic about its investments, making certain they are highly visible, affordable, and easy to implement. To borrow a line from Fred Kent of Project for Public Spaces, “lighter, cheaper, quicker” brings the greatest benefit to placemaking through suburban revitalization. Our commercial corridors can continue to thrive, so long as we allow them to evolve and change through community-based solutions implemented with community-generated revenues.

Lynée L. Wells, AICP, is a community planner and project manager for Williams & Works. You may contact her at 616-224-1500 or [email protected].